Is amazon flex 1099.

AMAZON FLEX VISA ® DEBIT CARD OFFERED ... You also understand that Amazon may issue an IRS Form 1099 indicating the approximate retail value of certain Rewards to relevant taxing authorities for tax reporting purposes. Please consult your tax advisor if you have any questions about your personal tax situation.

Mar 11, 2022 · This video provides step by step instructions on How to Download your 1099 Tax Form from Amazon from Amazon Seller Central. I also explain why the 1099 does ... Make quicker progress toward your goals by driving and earning with Amazon Flex.Maximize your earnings with Amazon Flex Rewards. With Amazon Flex Rewards, you earn points by making deliveries. As you earn more points, you’ll level-up and gain access to new rewards. You’ll have access to exclusive discounts on a wide range of categories like gas, roadside assistance, and car maintenance, in addition to cash back on ...👉 Increase Your Earnings. Gig Economy Masters Course. Only $14: https://coursecraft.net/courses/z9YkK👉 Find the highest paying gigs in your city: https://g...Pay up. 4. Tax on $600 is nothing and after expenses (mileage deduction) plus your personal deduction , you likely will not pay anything any way. The $600 rule is no longer a thing, the IRS changed the ruling. THEY, meaning Amazon, do not HAVE to report it to the IRS.

With Amazon Flex, you work only when you want to. You can plan your week by reserving blocks in advance or picking them each day based on your availability. Choose the blocks that fit your schedule, then get back to living your life. Start earning. Use your own vehicle to deliver packages for Amazon as a way of earning extra money to move you ...

Pay up. 4. Tax on $600 is nothing and after expenses (mileage deduction) plus your personal deduction , you likely will not pay anything any way. The $600 rule is no longer a thing, the IRS changed the ruling. THEY, meaning Amazon, do not HAVE to …Aug 18, 2023 · Step #2. Get your 1099 forms. If you earned at least $600 during the tax year, Postmates should send you a 1099 form documenting how much you earned on the platform. You can expect to receive this form around January 31st. Don’t worry — we’ll cover what a 1099 is and how to use it when you file your taxes in a moment.

We would like to show you a description here but the site won’t allow us. Say you received two 1099-NECs from freelancing clients. One of them reported $5,000 in nonemployee compensation, while the other reported $1,000. Together, that's $6,000 in income that the IRS already knows about.You can get an Amazon Flex pay stub in one of three ways: Use the Amazon Flex app: If you’re using the app to drive for Amazon Flex, you can see all your earnings, including your pay stub, on the app. However, you won’t have a pay stub if you only use the app to find out where to pick up assignments. Call Amazon Flex: If you’re picking up ...To update your tax information: Log in to Amazon Associates. Hover over your email address at the top of the page. Click on Account Settings. Click on View/Provide Tax Information to review or update specific tax information. Click “Take Interview”. Once the tax interview is complete, you can follow the status of your submission on your ...Adams 1099 NEC 3 Up Forms 2022, Tax Forms Kit for 30 Recipients, 5 Part NEC Tax Form Sets with Self Seal 1099 Envelopes and 3 1096 (TXA22905NEC-22) 22. Save 29%. $1599. List: $22.49. Lowest price in 30 days. FREE delivery Fri, Aug 11.

As of April 2014, Flex shampoo is still produced by Revlon, although many varieties of Flex have been discontinued. Few stores carry the brand; however, it is available online at Amazon.com.

Payments. Payment Setup. What payment methods are available? Changing Payment Type. Check Fee. Payment Threshold Settings. When Do Changes to Payment Preferences Take Effect? Two-Factor Authentication when accessing payment details. FAQ - Fx4Cash - International Transfers Solution.

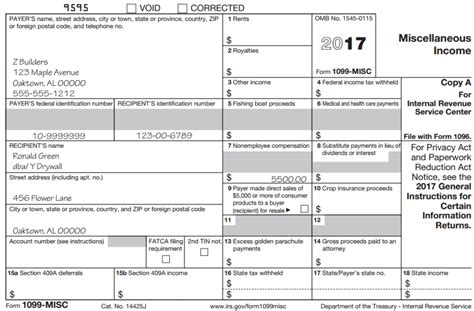

Apr 20, 2023 · If you are an Amazon Flex 1099 driver, payments close attention to this strain guide. You'll debt self-employment, quarterly and income taxes for the year. In this guide, we'll go over how file and maximize your tax savings at and end of to year. Jan 13, 2023 · Note: At the end of 2023, a new US tax reporting law will take effect and require Amazon to send out 1099-Ks to sellers who made $600 in sales with no transaction threshold. “For calendar tax years before 2023 (2022 tax year and earlier), Amazon is only required to issue a Form1099-K to you if you had: Amazon Flex Rewards is a program exclusively for Amazon Flex delivery partners to thank you for all the work you do. With Amazon Flex Rewards, you can earn cash back with the Amazon Flex Debit Card, enjoy Preferred Scheduling, and access thousands of discounts as well as tools to navigate things like insurance and taxes.U.S tax interviews collect the tax identity information in the form of a W-9 or W-8BEN form for all providers. This is used to determine whether US withholding tax is applicable to your payment. If you do not complete the interview, a default withholding tax of up to 30% may apply to your payments. Providers outside of the United States may be ...Este es un proyecto gigante de plataforma de Amazon, Amazon Flex hace que los trabajadores sean autónomos, para que puedan desempeñar el papel de repartidores de paquetes y envíos con sus propios vehículos. Los paquetes se pueden llevar en las horas que estés disponible y hace que los ingresos extras colaboren con su día a día.You can get an Amazon Flex pay stub in one of three ways: Use the Amazon Flex app: If you’re using the app to drive for Amazon Flex, you can see all your earnings, including your pay stub, on the app. However, you won’t have a pay stub if you only use the app to find out where to pick up assignments. Call Amazon Flex: If you’re picking up ...Amazon Flex drivers can expect to receive a 1099 form from the Amazon company if they earned at least $600 working for the service within the tax year. Let's take a closer look at what this means. 1099 Forms You'll Receive As An Amazon Flex Driver

Feb 16, 2022 · Hello, I'm wondering which section on Turbo Tax I file the below information. In 2021 I earned money via: Amazon Flex Doordash Mercari Construction Worker (1099) The company I worked as a construction worker for did not provide a 1099 but I only worked for 3 days and I know the gross amount I made... Download the Amazon Flex app. Becoming an Amazon Flex delivery driver is easy. Simply scan the QR code on the right using your iPhone or Android camera, and you will be …If you exceeded the $10 global royalty payment threshold across all Amazon businesses, you will be subject to IRS Form 1099-MISC reporting. Payments to corporations, including limited liability companies (LLCs) that are treated as C- or S- Corporations, and certain tax-exempt organizations are not reportable on Form 1099-MISC. Non-U.S. publishers.We'll issue a 1099 form by January 29 to any Amazon Associate who received payments of $600 or more or received payments where taxes were withheld in the previous calendar …This video provides step by step instructions on How to Download your 1099 Tax Form from Amazon from Amazon Seller Central. I also explain why the 1099 does ...

Amazon Flex driver jobs move items from location to location, and Amazon Flex Warehouse jobs that sort, organize and set up routes. The four types of outlets Amazon Flex drivers can take are: 1. Amazon Logistics. Amazon Logistics is a good choice for large vehicle owners but offers little to no tips.

Your required minimum payment is the lower of the following two amounts: 90% of your current year tax (hard to know if you vary your Amazon Flex hours). 100% of last year's tax (from Form 1040, Line 24 - Line 32). Note: if your AGI (Line 11) was greater than $150,000, you must use 110% instead of 100%.Amazon Flex is one of the highest paying gigs in the on-demand industry. Here's everything you need to know about Amazon Flex pay. ... It’s greatly important to consider that you are an independent contractor and will receive a 1099 for tax purposes. All income made through Amazon Flex is taxable and needs to be reported.The best tips for Amazon Flex & Amazon FBA drivers: 🚘 Take care of your car. As an Amazon Flex or FBA driver, it’s important to proactively take care of your car. You already know that it's important to have auto insurance. But did you know that it's also essential to keep a car maintenance log and adhere to a servicing schedule? It's true.As of Oct 16, 2023, the average hourly pay for an Amazon Flex Delivery Driver in the United States is $18.78 an hour. While ZipRecruiter is seeing hourly wages as high as $28.37 and as low as $8.41, the majority of Amazon Flex Delivery Driver wages currently range between $15.87 (25th percentile) to $20.43 (75th percentile) across the United ...Jun 5, 2023 · Getting your 1099 from Amazon Flex is a simple process of logging into your account and downloading it from the “Tax Documents” link. It is important to ensure that you receive your form by January 31st and to report any errors to Amazon Flex support as soon as possible. Aug 30, 2021 · As of now, Amazon Flex drivers are classified as independent contractors only. The federal and state income taxes you owe as well as self-employment taxes (Medicare and Social Security taxes) will be your responsibility. A 1099 form is issued to self-employed delivery drivers. TOPS 1099 NEC 3 Up Forms 2022, Tax Forms Kit for 30 Recipients, 5 Part NEC Tax Form Sets with Self Seal 1099 Envelopes and 3 1096 (TX22905NEC-22) 177. $1562. List: $22.49. FREE delivery Wed, Jul 5 on $25 of items shipped by Amazon. Only 14 left in stock (more on the way). The Amazon Flex app also provides safety videos, articles, and information on pet safety support on how to stay safe when a dog and pet is present. Optimized maps: Amazon Flex maps helps you navigate and shows known speed limits, road closure alerts, and live traffic conditions, so you can choose which route to take.Most Amazon Flex delivery partners earn $18-$25 per hour.* If you join us, you can build your own schedule, seven days a week. You can schedule work ahead or accept same-day offers when you have spare time. _____ You must be 21 or over and have a valid ID to be an Amazon Flex delivery partner.Jul 4, 2022 · The Amazon Flex website states you can earn up to $18 to $25 per hour before taxes and driving expenses. But this statement is slightly misleading because you earn a flat amount for each delivery block. For instance, earning $72 for a four-hour block boils down to $18 an hour. This is how Amazon states your hourly rate.

Jul 24, 2023 · In November 2021, the FTC sent payments to more than 140,000 Amazon Flex drivers totaling nearly $60 million. Now, the FTC is resending checks to people who did not cash their first check. If you get a check, please cash it within 90 days. If your payment is $600 or more, you will receive a 1099 tax form with your check.

The best tips for Amazon Flex & Amazon FBA drivers: 🚘 Take care of your car. As an Amazon Flex or FBA driver, it’s important to proactively take care of your car. You already know that it's important to have auto insurance. But did you know that it's also essential to keep a car maintenance log and adhere to a servicing schedule? It's true.

U.S. law requires Amazon.com to collect tax information from Associates who are U.S. citizens, U.S. residents, or U.S. corporations and certain non-U.S. individuals or entities that have taxable income in the U.S. We're obligated to have this information on file in order to make payments.Be the first to answer! Will having a state issued medical marijuana card allow me to be hired if test positive for THC? Asked November 10, 2021. Be the first to answer! Describe the drug test process at Amazon Flex, if there is one. Asked September 2, 2021. It is by swab of mouth. Answered September 2, 2021.Make quicker progress toward your goals by driving and earning with Amazon Flex. 1099 Driver Log Book: The Ultimate Log for Uber, Lyft, Uber Eats, Door Dash, Amazon Flex: Track Miles, Fuel, Tips, Gross & Net Pay, Repairs, and Taxes Paperback – August 25, 2021 by Ryo Jancic (Author)STADION FLEX FUND CLASS 1- Performance charts including intraday, historical charts and prices and keydata. Indices Commodities Currencies StocksYou can choose to do this once your amazon flex earnings go over £1,000 during a tax year if you like by taking advantage of the £1,000 trading income allowance. The deadline for registering is the 5th October following the end of the tax year you started working as a driver or your earnings go over the £1,000 limit.I started driving for Amazon Flex in November, yet only found out about the standard mileage deduction last week. I have a log of every "Block" I drove for Amazon Flex, would it be foolish of me to eyeball the number of miles driven based on the distance from my home-to-warehouse and estimate of how many miles I drove for each Block?If you have a Personal or a Business Account you will only receive a paper copy of Form 1099-K. However, if you have a Personal or a Business Account and another account, such as an Amazon Payments Seller Account (Checkout by Amazon and Pay with Amazon), or a Selling on Amazon Account, you will receive one 1099-K for your combined accounts.U.S tax interviews collect the tax identity information in the form of a W-9 or W-8BEN form for all providers. This is used to determine whether US withholding tax is applicable to your payment. If you do not complete the interview, a default withholding tax of up to 30% may apply to your payments. Providers outside of the United States may be ...

How do you get your Amazon Flex 1099 tax form? You can find your Form 1099-NEC in Amazon Tax Central. Internal Revenue Service regulations your Amazon Flex 1099 form download to be available by January 31st. NEC stands for nonemployee compensation.Oftentimes, during your Amazon Flex delivery blocks, new and unexpected situations can arise. Although you are an independent contractor, Amazon makes it very easy to reach their dedicated support line. ... Amazon Flex 1099 forms, Schedule C, SE ©2021 MoneyPixels.For a side gig or part-time job, you can earn decent extra income working as an Amazon Flex driver.Dec 8, 2021. Is Amazon flex a 1099 job? Amazon Flex drivers can expect to receive a 1099 form from the Amazon company if they earned at least $600 working for the service within the tax year. Does Amazon Flex pay for fuel UK?Instagram:https://instagram. matures dressed undressedcvs covid booster shotsinstalling veranda vinyl fencecinesubz.co I've been an independent contractor for Amazon Flex for the past 18 months. In that time I've driven thousands of miles and delivered thousands of packages everywhere from museums, companies, apartments, homes, police stations, and shacks in the middle of nowhere. Disclaimer: I in no way represent Amazon, I just work for them. oasis asian massage cutler bay reviewsnearest aldi to me For a side gig or part-time job, you can earn decent extra income working as an Amazon Flex driver.Dec 8, 2021. Is Amazon flex a 1099 job? Amazon Flex drivers can expect to receive a 1099 form from the Amazon company if they earned at least $600 working for the service within the tax year. Does Amazon Flex pay for fuel UK? god frequency wikipedia In Federal, left margin, select Wages & Income. On the Your income and expenses screen, scroll down to the last section, Less Common Income. Click Start across from Miscellaneous Income, 1099-A, 1099-C. On the next screen, Let's Work on Any Miscellaneous Income, click Start across from Hobby income and expenses.Amazon Flex Driver: How to File Your TAXES in 2022! | 1099-NEC. Hi friends. In todays video, I wanted to share with you guys how to file a tax return if you are …